Now Is A Good Time To Start Building A Position In CVS Health

CVS Health (CVS) is one of the very few companies in the market to have not withdrawn the fiscal 2020 guidance. The company has also come out with solid first-quarter performance, partly driven by panic-buying in March 2020. However, despite the overall favourable performance, CVS Health continues to be unloved on the market.

More: Earn More Than 100% Income on Your Money Every Year… for Life.

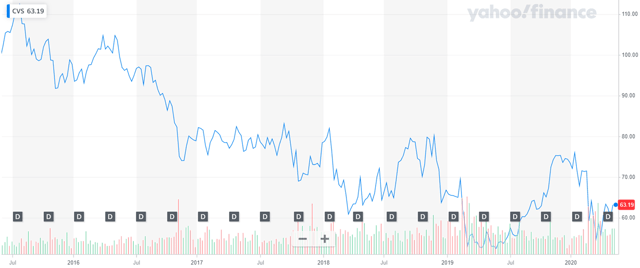

The chaos caused by the COVID-19 pandemic brought down almost all stocks in mid-March and CVS was no exception. The stock fell from $73.05 on January 2 to $51.87 on March 16. Although the stock has somewhat recovered in subsequent weeks, it remains down YTD (year-to-date) by 14.94%.

Although the company is facing challenges at various fronts, it remains without a doubt that CVS is a sturdy stock in these uncertain times. Pandemic or recession, people try not to forego essential medications. The need to remain compliant is even higher during current times, as people have been increasingly trying to avoid hospital and physician office visits due to the fear of contracting COVID-19 infection. CVS Health stands to benefit from these trends in 2020.

CVS Health is a robust dividend pick during the Covid-19 pandemic.

CVS’s current dividend yield is a solid 3.17%, much higher than the 10-year Treasury yield of 0.64% and S&P 500 dividend yield of 2.05%. Despite the high dividend yield, CVS’s payout ratio is only 30%. This implies that the company has sufficient wiggle room to sustain its dividend program. The company has grown its dividends by 2.87% annually from 2010 to 2019. In the first quarter, the company paid $650 million in dividends to shareholders.

From 2010 to 2019, CVS’s revenues have almost doubled, while net income has grown by 93.86%. At end of the first quarter, the company had access to over $11.0 billion cash, which includes cash and short-term investments on its balance sheet, proceeds from the bonds issued in March 2020, and $6.0 billion available through commercial paper or borrowing capacity under existing credit facilities. In the first quarter, the company also generated $3.3 billion in cash flow from operations. Although some of these initiatives will further increase debt as well as interest payments, the company plans to repay the incremental debt as soon as conditions revert to normal. The company also plans to optimize operational expenditure and reduce annual capital expenses by $200 million.

The company has $84.47 billion in long-term debt and capital leases, and $7.84 billion in short-term debt and capital lease obligations on its balance sheet at the end of the first quarter. This has translated into an annualized debt-to-Ebitda ratio of 5.02x at the end of the first quarter. This is quite high as compared to the company’s long-term leverage target of low 3xs. However, increased cash availability and robust profitability will ensure that there is no challenge in servicing these debts.

The company has $84.47 billion in long-term debt and capital leases, and $7.84 billion in short-term debt and capital lease obligations on its balance sheet at the end of the first quarter. This has translated into an annualized debt-to-Ebitda ratio of 5.02x at the end of the first quarter. This is quite high as compared to the company’s long-term leverage target of low 3xs. However, increased cash availability and robust profitability will ensure that there is no challenge in servicing these debts.

CVS Health’s solid revenue-generating and debt servicing capability further guarantee the sustainability of its dividend program.

The company has developed a robust strategy to counter the headwinds in the retail pharmacy business.

Although e-commerce sites have emerged as a major threat for pharmacy retailers, CVS Health has taken the challenge head-on.

The company partnered with United Parcel Service (UPS) in April 2019, wherein UPS subsidiary UPS Flight Forward (UPSFF) started using drones to deliver prescription medicines from a CVS pharmacy to The Villages, Florida for the largest U.S. retirement community, home to more than 135,000 residents. In July 2019, the two companies announced the addition of UPS Access Point locations in standalone CVS Pharmacy locations nationwide, allowing consumers to pick up and return packages. The collaboration was planned for more than 6,000 stores in the U.S. In October 2019, UPS and CVS collaborated to develop a drone delivery service for prescription drugs.

CVS has also come up with the HealthHub concept, wherein drugstores are remodeled into health service centers. HealthHub includes expanded health clinic, laboratory for blood testing and health screening, wellness rooms for yoga and seminars, and dietitians and respiratory specialists in addition to traditional drug dispensing services. These services cannot be easily duplicated by e-commerce players. Further, HealthHub aims to provide affordable healthcare services to around 30 million Americans without health insurance. The number will now only go up, as the world stares at a huge spike in the unemployment rate and an impending recession.

More: Marc Lichtenfeld, Author of International Best-Seller Get Rich with Dividends, Reveals…

Although CVS has made these services available in only a few places as of now, the company plans to rapidly expand this concept across the country. In places where HealthHub has been introduced, same-store sales are already outpacing those of stores with the older formats. HealthHub stores are also seeing rising demand for non-prescription products. Finally, CVS is leveraging Aetna to ensure cost-optimal delivery of services to HealthHub customers. Although the Covid-19 outbreak has slowed down HealthHub expansion, this is definitely once strategic change that is helping boost CVS’s financial metrics.

There is no better time than the current pandemic for CVS to make its presence felt in the ever-expanding telehealth market. The utilization of telemedicine for virtual visits through MinuteClinic is up about 600% in the first quarter.

The company’s first-quarter performance benefited significantly from the COVID-19 outbreak.

In the first quarter, CVS reported revenues of $66.75 billion, a YoY rise of 8.29% and ahead of the consensus by $2.64 billion. The company’s non-GAAP EPS (earnings per share) was $1.91, ahead of the consensus by $0.28. COVID-19 related business activity in March added approximately $0.10 to first-quarter adjusted EPS. The company saw an acceleration of prescriptions dispensed, strong front store sales, and a modest reduction in discretionary medical utilization in March 2020.

In the first quarter, CVS Health’s pharmacy services segment’s revenues rose 4.2% YoY, while retail/long-term care segment revenues increased YoY by 7.7%. Much of the prescription growth in these two segments was fuelled by changing consumer behaviour due to the COVID-19 pandemic. In March 2020, the company increasingly saw patients transitioning from 30-day prescriptions to 90-day prescriptions. The company also reported early refills of maintenance medications in March 2020. Total adjusted scripts in the pharmacy services segment increased by 12.4% with approximately 125 basis points related to COVID-19 activity. In retail/ long term care business, adjusted script growth was 8.2%, with COVID-19 impacted adjusted script growth of around 200 basis points.

An increase in prescription growth was accompanied by a YoY rise of 8.5% in front store total revenues and an 8% YoY rise in same-store sales. This is obvious since increased traffic to CVS Pharmacy stores also led to increased purchase of products other than prescription drugs. The company also benefited from some stocking behaviour of non-prescription products due to the COVID-19 pandemic.

Finally, CVS Health’s Health Care Benefits business also benefited from lower expenses for in the first quarter. Hospitals and physicians have deferred elective procedures since mid-March. Patients are also actively avoiding physician visits. Hence, there has been an overall reduction in discretionary utilization. CVS’s Health Care Benefits business, previously Aetna’s health insurance business, saw its MBR (medical benefit ratio) improve YoY by 160 basis points in the first quarter. MBR calculates the medical costs of insurers as a percentage of total premiums. The reinstatement of the HIF (health insurance fee) in 2020 has also helped boost premiums collected, thereby further resulting in improved MBR.

Based on this performance, CVS Health has maintained fiscal 2020 GAAP EPS and adjusted EPS guidance range of $5.47 to $5.60 and $7.04 to $7.17, respectively. The company also reiterated CFO (cash flow from operations) guidance of $10.5 billion to $11 billion.

CVS Health may now face lesser allegations in the federal opioid litigation.

CVS Health may now face lesser allegations in the federal opioid litigation.

Drug retailers such as CVS, RiteAid (RAD), and Walgreens (WBA) will now face fewer allegations against them in federal opioid litigation. These companies are being held accountable for aggravating the opioid crisis by dispensing these addictive painkillers. On April 15, the U.S. appeals court ruled in favour of the pharmacy chains. This development has reduced overall investment risk in CVS Health.

Investors should consider these risks.

Although the COVID-19 outbreak proved beneficial for CVS’s pharmacy services and retail/long term care segments, it has negatively affected the net investment income of the company’s healthcare benefits segment. The company has also realized capital losses in its investment portfolio in the first quarter.

The second quarter is expected to be a tough one due to the impact of pull forward in March 2020. New prescriptions will also be low, considering that people are not comfortable visiting hospitals and physician offices. These trends were already obvious in April 2020, as prescription growth was flattish in both retail/long-term Care and pharmacy services segments. Front store sales which increasingly depend on customers visiting CVS stores may also be low in 2020, as evidenced by an 11% YoY drop in April 2020.

CVS is making significant operational investments for ensuring employee safety and business continuity amidst the pandemic. On March 23, the company announced bonuses for frontline workers. Further, the company announced plans to immediately fill 50,000 full-time, part-time and temporary roles across the country.

Further, while the reduced utilization of discretionary utilization since Mid-March may temporarily benefit CVS’s Health Benefit business, it may pose challenges in the long-term. Many members with chronic conditions are expected to progress on their conditions in the absence of timely treatment. This can result in increased healthcare costs in the long term. These trends may increase margin pressures for CVS.

CVS Health also carries a sizable debt of around $92 billion on its balance sheet. The debt has mainly increased after the acquisition of Aetna in 2018. Finally, pharmacies and other brick and mortar drug retailers have come under intense pressure due to the increasing penetration of e-commerce platforms in the pharmacy segment. Amazon (AMZN) and several other companies have been aggressively expanding their presence in this market.

What price is right here?

According to finviz, the 12-month consensus target price of CVS Health is $79.29, implying an upside potential of 25.48% from its last close. The company is trading at PE (price-to-earnings) multiple of 11.44x, forward PE of 8.41x, and P/S (price-to-sales) multiple of 0.32x, which is actually pretty cheap for one of the largest essential service providers in today’s uncertain market. I believe that the target price of $79.29 is indicative of the true growth potential of the stock in the next 12 months.

The potential share price appreciation of 25.48% at current low valuations make CVS a good pick for value investors. Income-seeking investors will also like CVS for its healthy dividend stream. Besides, CVS is a relatively safe stock considering that its beta is only 0.71.

Analysts are mostly positive about CVS. On May 14, Credit Suisse with analyst A.J. Rice upgraded the company to Outperform from Neutral rating and reiterated the target price of $75. On March 25, RBC Capital analyst Anton Hie lowered the firm’s price target on CVS Health to $81 from $85 but reiterated Outperform rating. On March 24, Cowen analyst Charles Ryhee reiterated Outperform rating and target price of $84.

I believe this defensive stock can be a good pick for retail investors with average risk appetite and investment horizon of at least one year. However, investors should remember that the company has not increased its fiscal 2020 guidance despite outperformance in the first quarter. This implies a possible setback in performance in the second quarter. In case of actual performance falling short of consensus estimates, there may be some emotional selling which may cause a dip in prices. Since it is quite difficult to catch the bottom of a stock, investors should take a small position in May 2020 and gradually build up the exposure in the stock over the next four-five months.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. (other than from writing costs ). I have no business relationship with any company whose stock is mentioned in this article.

Recent Comments